Market

By Christopher M. Uhl

The political world is buzzing after a judge in New York City adjourned Trump’s sentencing, leaving some charges unresolved and raising more questions than answers. This is just the latest twist in the saga of Teflon Don, who continues to galvanize his base amid a backdrop of legal drama. But while headlines focus on Trump, savvy investors are looking elsewhere: the markets.

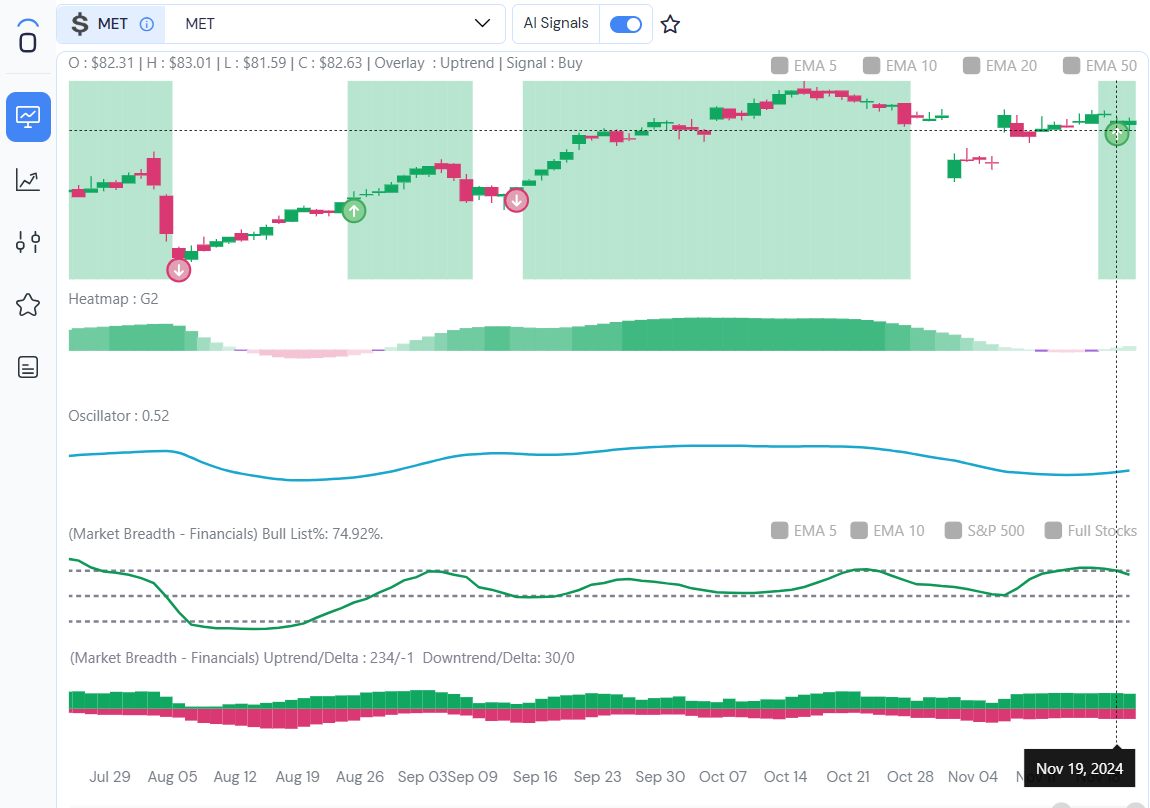

Today, market breadth paints an uncertain picture. Although the NASDAQ bounced back with a 1% gain after a morning dip, broader indicators suggest caution. For instance, MetLife ($MET), a prominent financial stock, has been under scrutiny. Using Outlier’s data-driven insights, we can see MetLife’s sector breadth has dropped below a key threshold of 75%. This decline signals hesitation among financial stocks, discouraging trades in this sector for now.

Why is this important? When sector breadth stalls or contracts, it often suggests a cooling in market enthusiasm. Despite temporary recoveries in indices like the NASDAQ, underlying trends can provide more reliable signals for traders. For MetLife, the pullback implies caution—not just for the stock but for financials as a whole.

This illustrates the power of sticking to disciplined strategies. Emotional reactions to big news stories—whether political or market-related—can lead to poor decisions. Tools like Outlier allow traders to focus on price action, not hype. As Trump’s legal battles rage on and geopolitical fears wax and wane, staying grounded in market data remains essential.

The takeaway? While Trump’s courtroom victories may dominate headlines, the market rewards those who trade with precision. Whether it’s MetLife or other stocks, watch the data—not the drama.