Market

By Christopher M. Uhl

The Federal Reserve just slashed U.S. interest rates by 0.25%, aligning the federal funds rate to 4.75%. While this may sound like a win for markets, the rate cut comes on the heels of Trump's re-election—a factor that’s thrown the Fed’s 2025 roadmap into flux. Originally, the Fed aimed to reduce rates to 3.5% by the end of 2025. However, Trump’s economic policies, including tax cuts and potential tariffs, have forced a rethink. These changes could fuel inflation, complicating the Fed's balancing act between supporting the economy and keeping inflation in check.

Market participants are keeping a close eye on this pivot. Investors betting on steady rate reductions might need to recalibrate expectations, as the Fed hinted at a slower pace for further cuts.

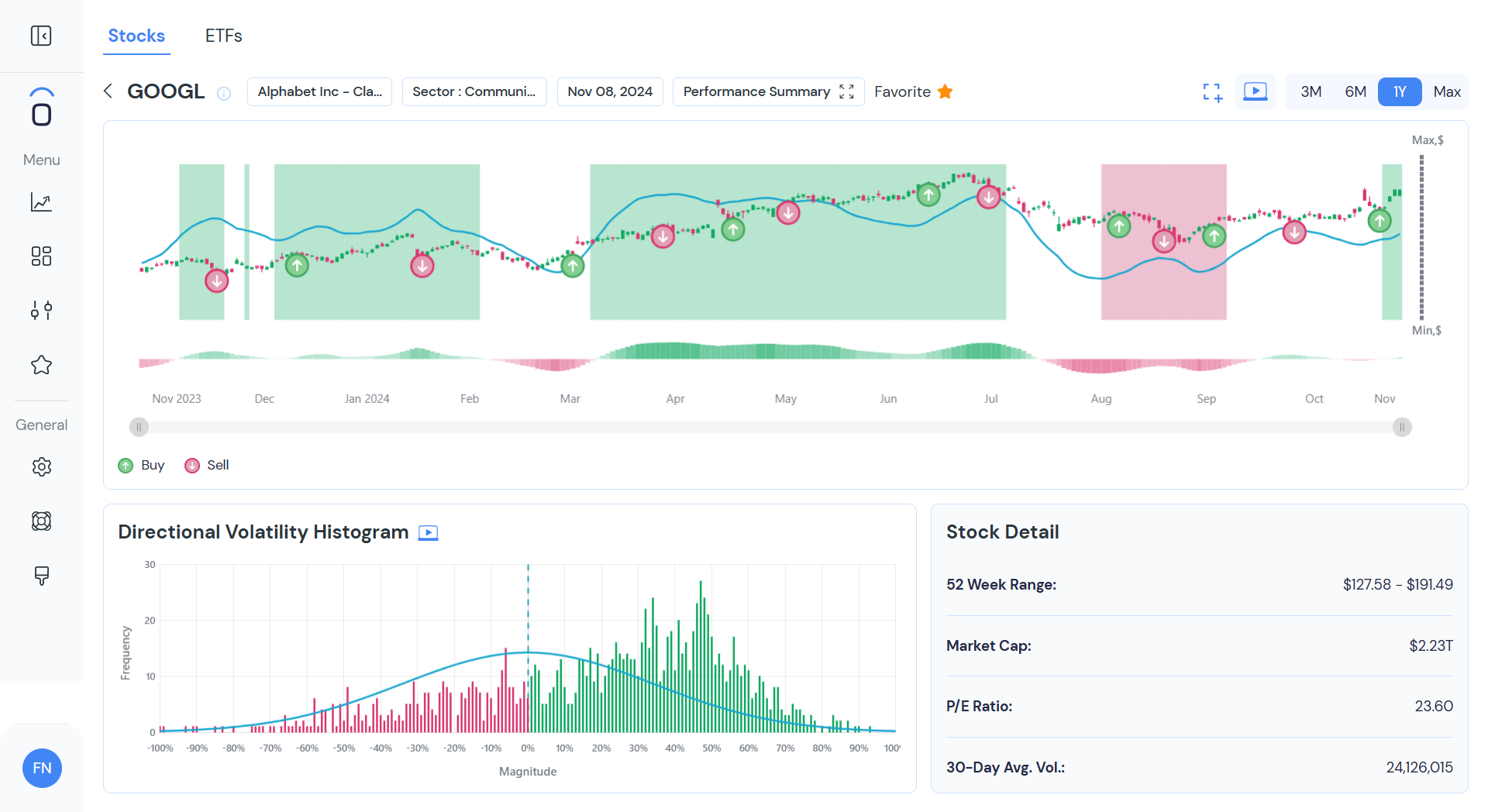

Amid this backdrop, let’s highlight Alphabet (GOOGL) from today’s market analysis. GOOGL popped 3% in just an hour, reflecting bullish sentiment fueled by the broader rate cut optimism. The stock has been riding high on solid earnings and its AI advancements, but traders should tread carefully. Volatility can spike as investors digest Fed comments and potential impacts of Trump’s policy shifts.

For traders, this mix of Fed dynamics and political shifts offers opportunities and risks. With GOOGL's trajectory and the Fed's evolving stance, leveraging tools like OVTLYR's Power Scanner can provide a data-driven edge to navigate these waters. Stay tuned, as December’s Fed meeting promises even more insights on their 2025 strategy.