Market

By Christopher M. Uhl

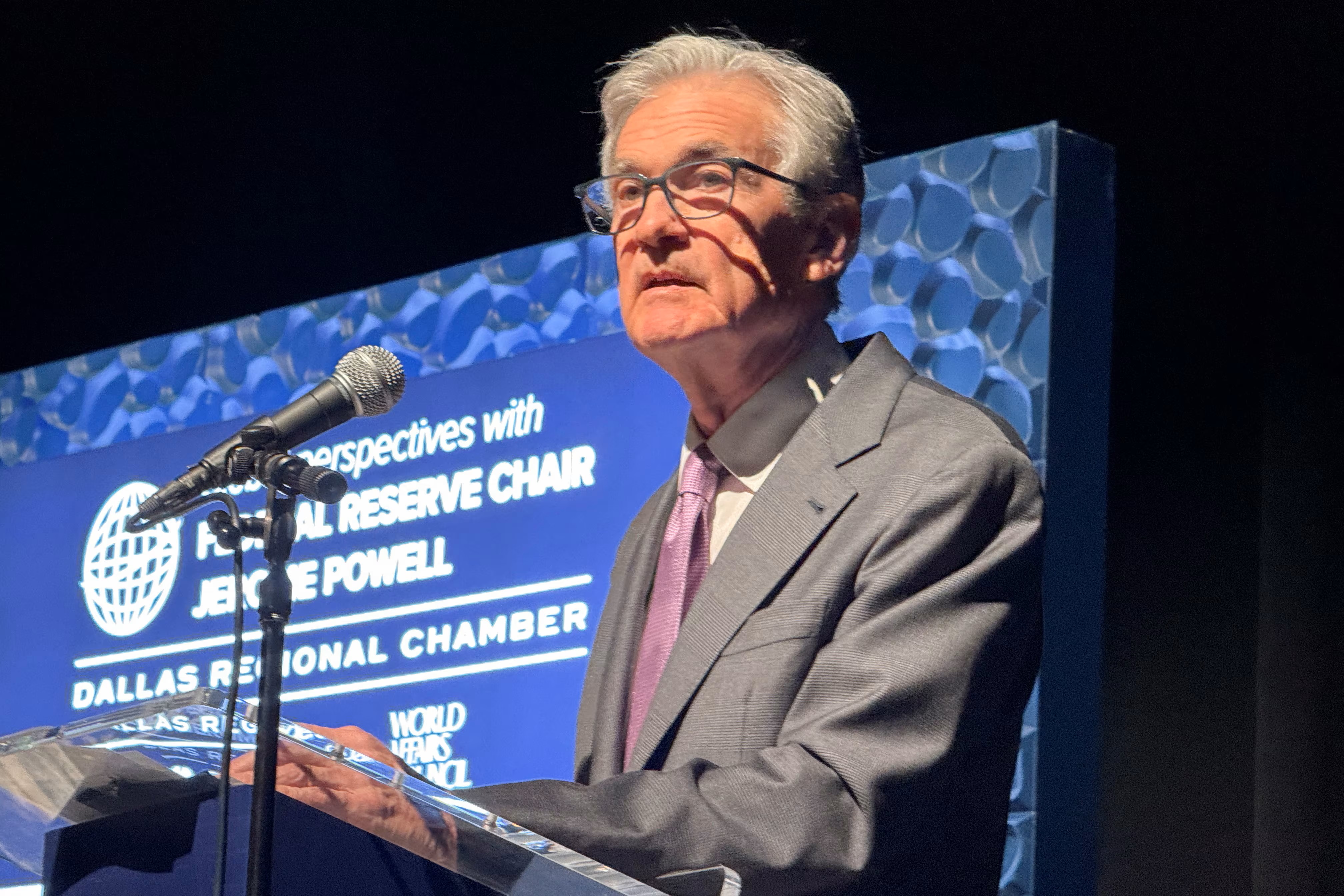

I had the chance to attend Jerome Powell’s recent speech at the Federal Reserve Bank of Dallas, and it was an interesting experience. Powell spoke about the Fed’s current stance and how they’re navigating the tricky balance between inflation and employment. While the event was filled with press and finance pros, the real value came from hearing firsthand how the Fed’s decisions impact the markets we trade every day.

One thing Powell made clear is that the Fed isn’t here to play politics. He sidestepped questions that veered into political territory, like immigration, and kept the focus on monetary policy. That’s exactly what you’d want from the Fed—keeping their eyes on the economy and staying data-driven. For traders, this is a reminder of how much weight the Fed carries. A single comment from Powell can send markets swinging, so understanding his signals is critical.

During his speech, Powell hinted that future rate hikes are still on the table, but only if the data calls for it. It’s a cautious approach, and it leaves room for the Fed to adapt as new numbers come in. For us, that means staying flexible and watching how sectors like financials react.

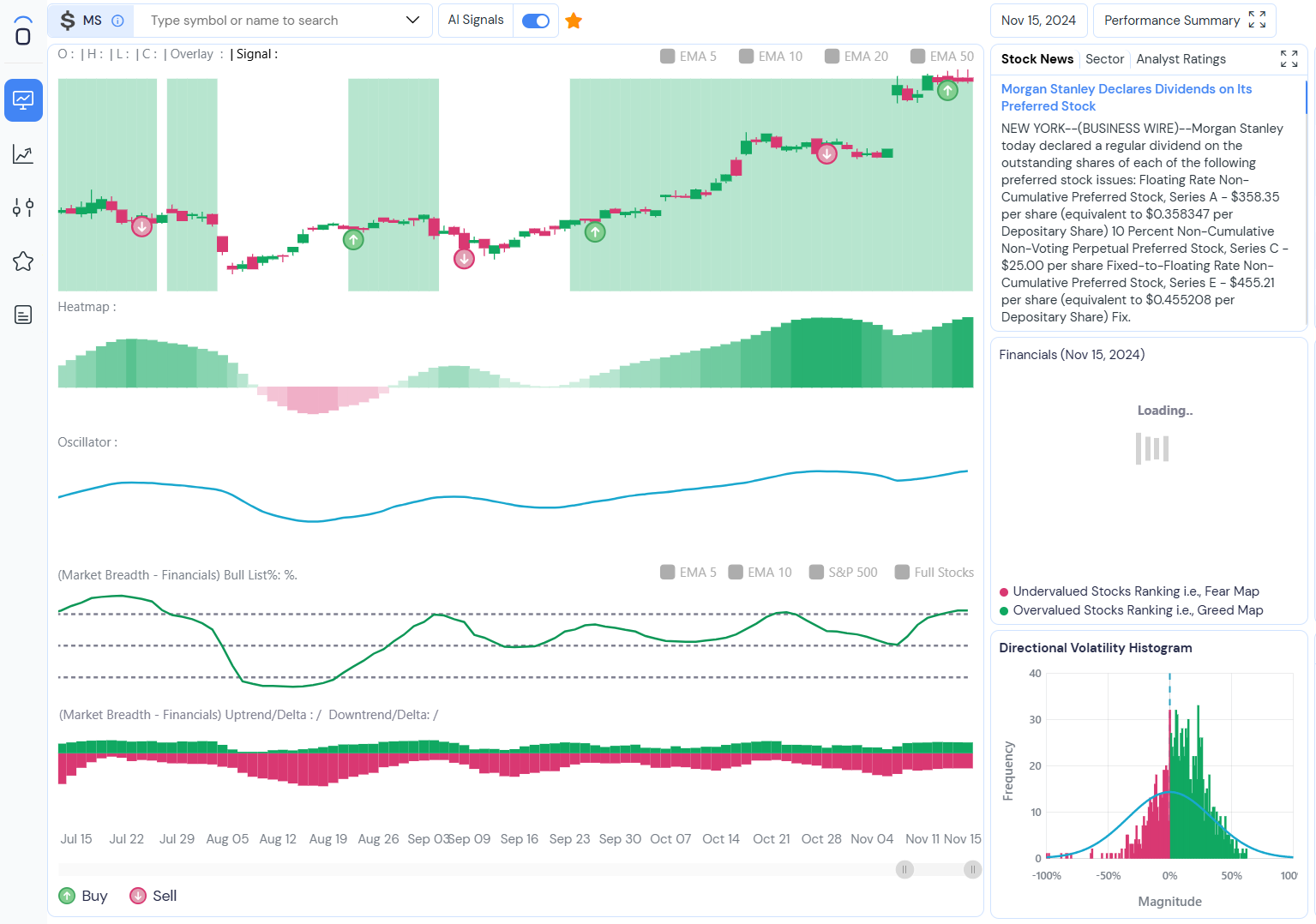

Take Morgan Stanley (MS) as an example. Recently, it provided a textbook setup for a trade. I’ve been refining a rule to skip stocks that make big moves—5% or more—before a buy signal. Morgan Stanley stayed within that range, and the trade worked out nicely with a solid $2 per share gain. It’s not about hitting home runs but consistently capturing these opportunities with a disciplined approach.

What stood out at the event was the sheer importance of Powell’s words. His cautious optimism set the tone for markets, reminding everyone that the Fed’s moves are deliberate and calculated. As traders, it’s our job to take that context and apply it.

Powell’s speech reinforced a key lesson: trading isn’t just about reacting to market noise. It’s about understanding the broader picture, aligning strategies with the Fed’s outlook, and focusing on data to make smarter decisions. Events like this remind you why staying informed and sticking to a solid game plan matters.