Market

By Christopher M. Uhl

Elon Musk and Vivek Ramaswamy are on a mission to clean up Washington’s act with their bold idea: a “Department of Government Efficiency” (Doge). They’re talking about cutting through the red tape and wiping out over $500 billion in unauthorized spending. Bold? Absolutely. Realistic? That’s up for debate. Critics are skeptical, but Musk and Ramaswamy insist their outsider, business-first mindset is exactly what Washington needs to run smoother and leaner.

Here’s where it gets interesting: Musk’s platform, X (formerly Twitter), gives him a direct line to millions, and he’s not shy about calling out inefficiencies. Imagine him tweeting about wasteful spending or government delays, rallying public support and putting lawmakers on blast. If they pull this off, we could see a government that operates more like a tech company—quick, efficient, and cost-effective. For traders, this isn’t just political theater; it’s a potential shake-up for industries that rely heavily on federal funding, like defense and healthcare. Keep an eye on those sectors because any shifts in spending could ripple through the market.

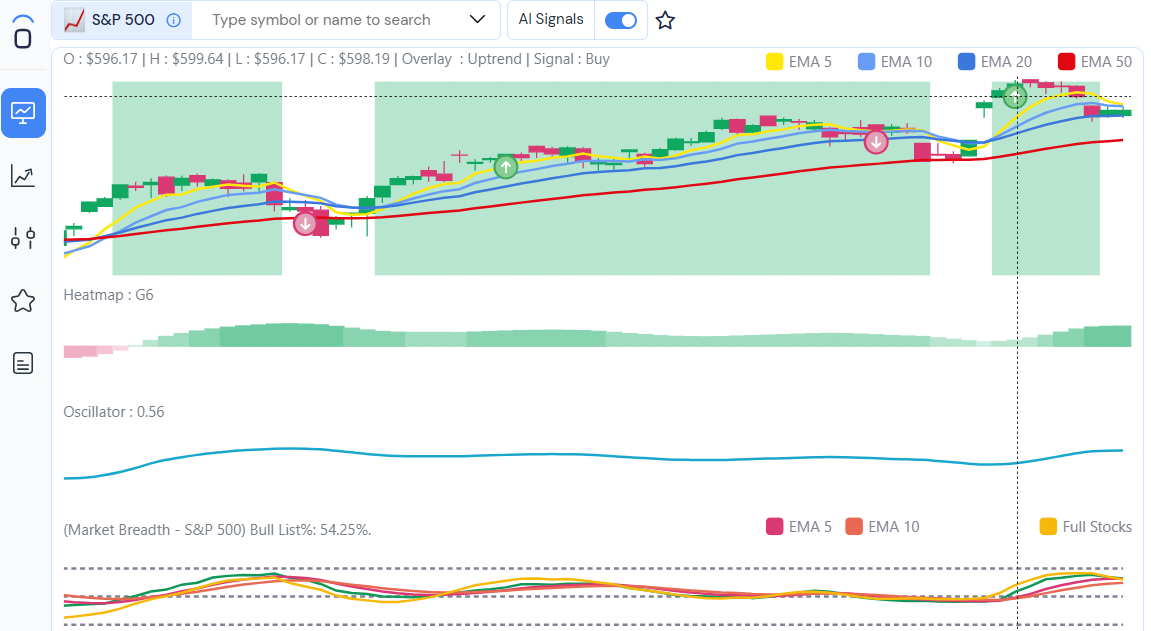

Speaking of market ripples, let’s talk about what’s happening now. SPDR S&P 500 ETF Trust (SPY) just dropped below its 20-day moving average—a classic warning sign. When SPY makes a move like that, it’s a signal to hit pause on new trades. Why? Because the market’s momentum is weakening, and diving in without a clear trend could be a costly mistake. This isn’t the time to chase trades. Instead, it’s about staying patient, watching for stronger signals, and avoiding the choppy waters of a sideways market.

It’s moments like these that separate smart traders from the rest. Stick to the fundamentals: respect your moving averages, don’t force trades in uncertain conditions, and always have a clear exit strategy. While Musk and Ramaswamy tackle inefficiencies in the government, your job is to stay laser-focused on maximizing your portfolio’s efficiency. After all, navigating the market isn’t about luck—it’s about strategy, discipline, and timing.