Market

By Christopher M. Uhl

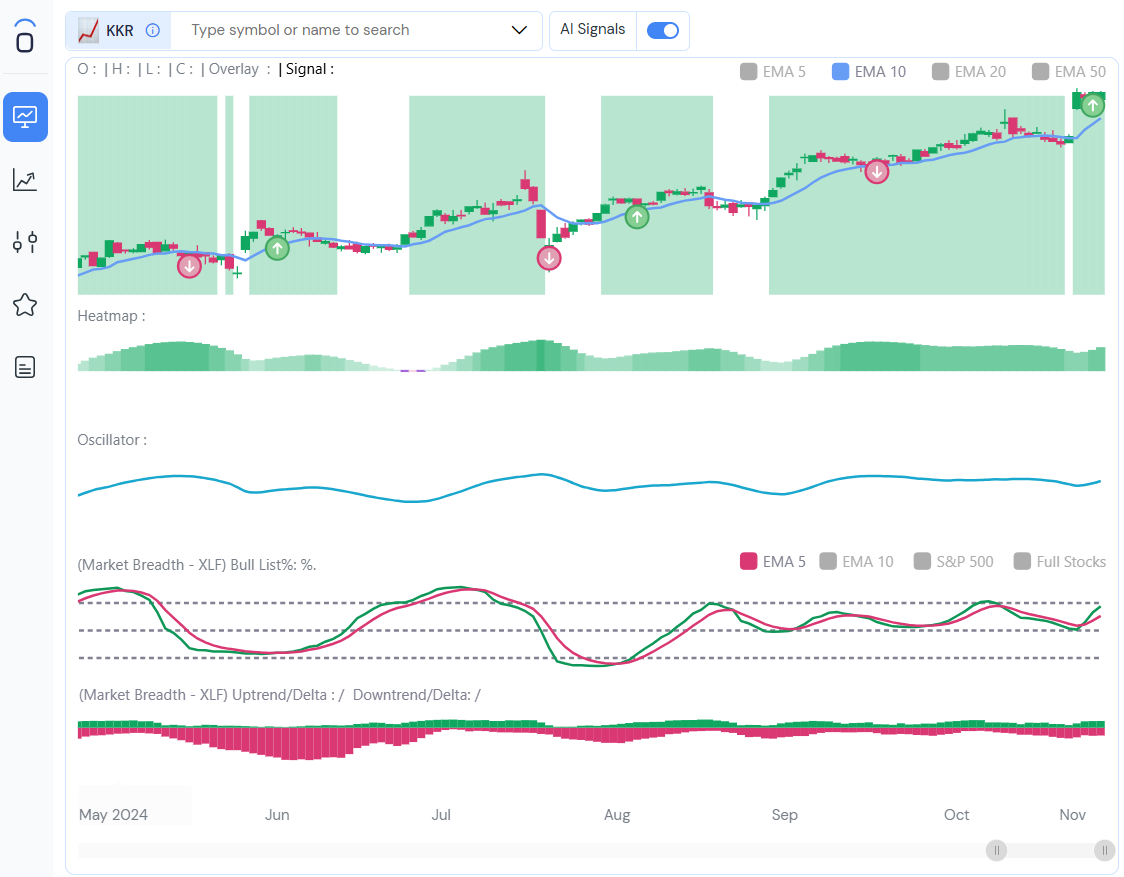

The market never stands still, and with Trump back in the spotlight, it's time to explore the opportunities his presidency presents. Investors are buzzing about the so-called "Trump Trades," with sectors like financials, industrials, and energy seeing bullish momentum. Today, we’re taking a closer look at one stock making waves: KKR.

KKR, a global private equity leader, has emerged as a strong candidate for bullish trades. According to recent analysis, KKR boasts an 89% win rate using our Golden Ticket trading strategy. Even with a modest 43% success rate on certain setups, its average wins are three times larger than its losses, making it a prime example of why risk management and expectancy matter in trading.

The market sentiment today is overwhelmingly bullish, with every sector showing strength. This kind of broad-based momentum often signals the beginning of a sustained rally. KKR is well-positioned within this environment, as private equity tends to thrive under pro-business policies and deregulation, which align with Trump’s economic agenda.

When trading a stock like KKR, it's crucial to stay disciplined. With tight spreads and high liquidity in the options market, this trade is accessible for a range of investors. By leveraging options strategies, traders can maximize their upside while keeping risk in check.

As we monitor this evolving market, the focus remains on capturing gains while staying nimble. Whether you're trading KKR or exploring other Trump Trades, the key is to align with the market’s momentum and manage your risk effectively. Let’s capitalize on this wave and keep pushing forward.